House Minority Leader Nancy Pelosi: “As I’ve said to you before, Plan B is to send a bill to your children and grandchildren in order to give a tax cut to the wealthiest people in our country, and still those making over a million dollars get a $50,000 tax cut, we’ll add nearly a half a trillion dollars to the deficit. A half a trillion dollars to the deficit. Again, 25 million working families, under this Plan B, will pay an average $1,000 more in taxes. Some of that by harming the Child Tax Credit, and other provisions, others of it in this bill that comes up after this – their bill, their reconciliation bill – more than 20 million children will have reduced food and nutrition benefits.”

House Minority Leader Nancy Pelosi: “As I’ve said to you before, Plan B is to send a bill to your children and grandchildren in order to give a tax cut to the wealthiest people in our country, and still those making over a million dollars get a $50,000 tax cut, we’ll add nearly a half a trillion dollars to the deficit. A half a trillion dollars to the deficit. Again, 25 million working families, under this Plan B, will pay an average $1,000 more in taxes. Some of that by harming the Child Tax Credit, and other provisions, others of it in this bill that comes up after this – their bill, their reconciliation bill – more than 20 million children will have reduced food and nutrition benefits.”

Overview

House Minority Leader Nancy Pelosi (D-Cal.) twists the tale of the tax with her statement on the Republican “Plan B” tax proposal.

The Facts

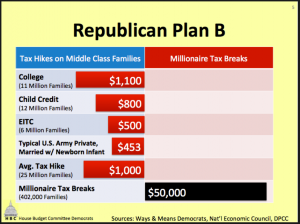

Pelosi and the White House made similar statements about the Republican tax plan, the former referencing a chart sourced to “Ways & Means Democrats, Nat’l Economic Council, DPCC.”

The chart features one column listing “Tax Hikes on Middle Class families. The adjacent column shows “Millionaire Tax Breaks” to with one $50,000 item.

The center-left Tax Policy Center did a separate evaluation of the plan, publishing a series of tables to the Web on Dec. 19.

The bill, an amendment to Joint House Resolution 66, is summarized on a page hosted by the GOP.

Analysis

If we assume that the numbers on Pelosi’s chart are correct, it still represents an apples-to-oranges comparison. A tendency toward cherry picking makes the chart even more fruity.

To illustrate, we magnified some of the findings of the TPC evaluation.

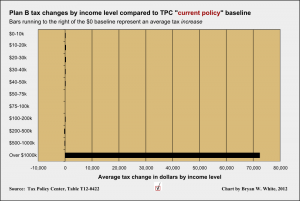

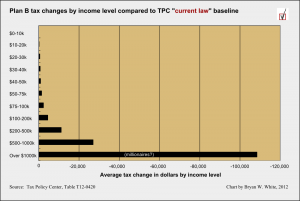

The TPC produced two types of charts evaluating Plan B. One type measures tax changes compared to the way things are now, using the “current policy” baseline. The other type measures tax changes compared to the results of slipping over the fiscal cliff, using the “current law” baseline.

Figure A represents the TPC findings using the current policy baseline. It shows some income groups receiving an average tax increase and some income groups receiving an average tax increase. The average tax effects are relatively small except for one group: those with income greater than $1 million. That group pays an average tax increase of over $70,000 compared to current policy.

The Figure B graph looks superficially similar, but the “current law” baseline produces radically different results. All income groups listed receive an average tax cut, though we should stress that the TPC charts make clear that taxpayers in each group may end with a tax increase or decrease depending on the individual circumstances. All the income groups on the second graph receive an average tax break compared to the “current law” scenario–the so-called fiscal cliff.

The illustration shows that Pelosi’s chart is very misleading as a generalization of Plan B’s tax effects. We don’t have to take the chart as a generalization, of course. We can take it as cherry picking.

Cherry picking?

How do Pelosi and company reach the conclusion that Plan B hikes taxes on average folks while giving millionaires a tax break? Apparently by cherry picking. It is true that Plan B has tax effects that give some taxpayers across the lower-income groups an increased net tax burden, largely by trimming various tax credits. It’s also true that Plan B’s tax changes give some millionaires tax breaks. Under the TPC’s comparison to current policy, for example, 11 percent of millionaires receive an average tax decrease of $129 while the average for the entire group is a tax increase of over $70,000 (Fig. A). That’s because 72.9 percent in that group receive an average tax increase of $99,296.

Focus on the “Tax Hikes on Middle Class Families”

The chart Pelosi cites lists three specific “Tax Hikes on Middle Class Families.” We’ll narrow our focus to items on that chart to help provide context to Pelosi’s claim that tax hikes on working families pay for tax cuts for millionaires.

The American Opportunity Tax Credit

The AOTC offers an education tax credit of up to $2,500 for eligible tax filers. The AOTC was one of the tax breaks introduced in the stimulus bill President Obama signed into law in 2009. Plan B allows the AOTC to expire. Two smaller college tax credits worth up to $2,000 and $1,800 remain in effect for most taxpayers who would have claimed the AOTC.

The Child Credit

The Child Tax Credit, like the AOTC, was expanded by the stimulus bill. The American Reinvestment and Recovery Act expanded eligibility for the refundable portion of the credit by significantly lowering the minimum income needed to claim it. Plan B allows the ARRA expansion of the CTC to expire.

The Earned Income Tax Credit

As with the previous two examples, the Earned Income Tax Credit was altered by the ARRA to increase the maximum value of the credit and make it available to more filers. The ARRA made the credit available to more filers by expanding its phase-out limits.

The set of “Tax Hikes” relies entirely on taking tax credits in isolation from other tax changes in Plan B. Each credit is scheduled to expire as part of the effect of the “Fiscal Cliff.” Therefore, none of Pelosi’s three “Tax Hikes” impact the effect of Plan B under the “current law” assumptions from the TPC. Instead, we see the effects on Fig. A, where the tax changes compare Plan B to the current policy. Fig. A helps illustrate Pelosi’s problem with cherry picking. Using the “current policy” baseline for comparison, those earning over $1 million have an average tax hike of over $70,000. Pelosi, in effect, uses the Fig. A chart to calculate tax increases on working families and compares it to a tax cut for millionaires from Fig. B. And Fig. B shows all income groups receiving an average net tax cut under Plan B.

Charitable Interpretation

Do working families get a tax increase under Plan B? Yes, using current policy as the baseline, many working families will pay more in taxes because tax breaks originally passed under the ARRA will lapse.

Do millionaires receive a tax break under Plan B? Yes, using current law as the baseline, most millionaires will receive a tax break under Plan B.

The above interpretation requires considerable charity because using two different baselines encourages the audience to reach false conclusions about Pelosi’s two tidbits of truth. The false conclusions stem from fallacies of ambiguity, and Pelosi helps that along with cherry picking. Cherry picking occurs as the “Texas Sharpshooter” fallacy from the YourLogicalFallacyIs.com list.

Do the lower-income Americans pay for the tax cut received by the millionaires? Not directly, but with an extremely charitable interpretation, one can reason that the millionaires don’t get their beneficial tax provision without the sunset of the three tax credits. Higher income earners bear the bulk of the tax burden regardless, as the Tax Policy Center charts show, and millionaires pay a higher percentage of the Fig. A tax increase than any other income group listed as a percentage of after-tax income.

Updated Dec. 26, 12:34 p.m. with addition of “Texas Sharpshooter” fallacy icon along with descriptive text.

References

“Pelosi: Plan B Sends Bill to America’s Children and Grandchildren to Give Tax Breaks to Millionaires.” Democratic Leader Nancy Pelosi. House Democratic Leader Nancy Pelosi, 20 Dec. 2012. Web. 23 Dec. 2012.

Slack, Megan. “Get the Facts about House Republicans’ ‘Plan B’” The White House Blog. The White House, 20 Dec. 2012. Web. 23 Dec. 2012.

The National Economic Council. “The President’s Proposal to Extend the Middle Class Tax Cuts.” Whitehouse.gov. The White House, July 2012. Web. 25 Dec. 2012.

“Speaker Boehner’s “Plan B” Proposal.” Speaker Boehner’s “Plan B” Proposal. Tax Policy Center, 19 Dec. 2012. Web. 22 Dec. 2012.

“H.J.Res. 66 Amendment: House Amendment to the Senate Amendment to H.J. Res. 66 – The Permanent Tax Relief for Families and Small Businesses Act of 2012 – Legislative Digest – GOP.gov.” GOP.gov. GOP, 20 Dec. 2012. Web. 24 Dec. 2012.

“TPC Baseline Definitions.” Tax Policy Center. Tax Policy Center, 9 Aug. 2011. Web. 26 Dec. 2012.

“The Permanent Tax Relief for Families and Small Businesses Act of 2012 (Speaker Boehner’s Plan B Proposal); Baseline: Current Policy; by Cash Income Level, 2013.” Tax Policy Center. Tax Policy Center, 19 Dec. 2012. Web. 23 Dec. 2012.

“The Permanent Tax Relief for Families and Small Businesses Act of 2012 (Speaker Boehner’s Plan B Proposal); Baseline: Current Law; by Cash Income Level, 2013.” Tax Policy Center. Tax Policy Center, 19 Dec. 2012. Web. 23 Dec. 2012.

“What’s in Plan B?” Committee for a Responsible Federal Budget. Committee for a Responsible Federal Budget, 19 Dec. 2012. Web. 25 Dec. 2012.

Onink, Troy. “College Tax Credit: The $2,500 American Opportunity Tax Credit.” Forbes. Forbes Magazine, 03 Mar. 2012. Web. 25 Dec. 2012.

Kneebone, Elizabeth. “The Child Tax Credit after ARRA: How Would Expiration Affect Metropolitan Families?” The Brookings Institution. The Brookings Institution, 8 July 2010. Web. 25 Dec. 2012.

“ARRA and the Additional Child Tax Credit.” Irs.gov. Internal Revenue Service, 31 Oct. 2011. Web. 26 Dec. 2012.

“ARRA and the Earned Income Tax Credit.” Irs.gov. Internal Revenue Service, 31 Oct. 2011. Web. 26 Dec. 2012.