“Myth #2: Premium Prices Will Increase Due To Health Care Law”

“Myth #2: Premium Prices Will Increase Due To Health Care Law”

—Media Matters for America, Oct. 1, 2013

Overview

If saying it makes it true then Media Matters has a good argument.

The Facts

On Oct. 1, 2013, Media Matters for America published a list of what it calls “myths” about the health care law, commonly known as the ACA or “Obamacare.” Media Matters styles itself as a fact checker policing the media to ensure fair treatment of liberals and their ideas. Coming in at No. 2 on the “myth” list was the claim that the health care law will increase premiums. Media Matters thereby suggests that it is untrue—a myth—that the ACA will increase health insurance premiums.

On Oct. 25, 2011, mainstream fact checker Annenberg Fact Check published its assessment on whether the health care law would increase health insurance premiums. The Center for Public Integrity hosts a version of that article, which starts with this (bold emphasis added):

Health insurance premiums for employer-sponsored family plans jumped a startling 9 percent from 2010 to 2011, and Republicans have blamed the federal health care law. But they exaggerate. The law — the bulk of which has yet to be implemented — has caused only about a 1 percent to 3 percent increase in premiums, according to several independent experts. The rest of the 9 percent rise is due to rising health care costs, as usual.The article went on to say that the premium increases come from higher benefit levels required by the law, such as provisions that allow children to stay covered under their parents’ policies through age 26 and a requirement that insurance cover many types of preventive care in full without a co-pay.

Taxes embedded in the law, such as a tax on health insurance companies levied according to their market share, will also tend to increase premiums.

The law has other features, such as the employer and individual mandates, intended to decrease premiums by encouraging uninsured healthy people to buy insurance. People who buy insurance while receiving little benefit from the insurance help pay the bills for those receiving the benefits, potentially lowering the overall price of insurance.

Analyzing the Rhetoric

We don’t regard Media Matters for America as a serious fact checker, nor would we ordinarily waste time looking at its fact checks. We’re doing it in this case since the ACA has appeared more often in the news lately and to take advantage of the opportunity to show by example how Media Matters goes wrong in its methods.

In this fact check, we’ve noted above that Annenberg Fact Check looked at the question and found the ACA increased premiums, and we should note that we’re looking at nongroup premiums, which make up under 10 percent of the national insurance market.

We’ll focus on the arguments Media Matters uses to reach a conclusion at odds with that of Annenberg Fact Check.

“Lower than expected”

Media Matters starts with a claim of fact, perhaps intended to contradict the supposed myth it seeks to expose: “FACT: Premiums Will Be Lower Than Expected.” That claim, of course, is somewhat like claiming that if the planet warms less than expected then humans have nothing to do with global warming. Even if the globe warms less than expected humans may have contributed to warming. So it is with health insurance premiums.

As noted above, we’re looking at nongroup insurance, the type offered through the state health care insurance exchanges.

Media Matters cites a CBS News report in support of its claim, which in turn relies on statements from the Department of Health and Human Services as well as a report released through the HHS:

The weighted average second lowest cost silver plan for 48 states (including DC) is 16 percent below projections based on the ASPE-derived Congressional Budget Office premiums.

The ASPE is the Assistant Secretary for Planning and Evaluation. That office offers this explanation for “ASPE-derived” Congressional Budget Office premium estimates (bold emphasis added):

Throughout this document, we refer to the ASPE-derived CBO estimate. This is an estimate derived from CBO’s March 2012 estimate that the average premium for a family enrolled in the second lowest cost silver plan will be $15,400 in 2016. See the methods section for details on how we derived a 2014 single premium from CBO’s 2016 estimate.

The ASPE-derived estimate figures the 2014 premium by adjusting down by 5.5 percent annually backward in time from 2016 and by adding the estimated costs of a $63 per policy reinsurance tax to the 2014 figure. The CBO figure ignores the reinsurance tax.

Importantly, the CBO figure represents its estimate of premiums with the ACA in effect, and the report also estimates 2016 premiums according to the law in effect in 2009. What does that mean? It means an ASPE-derived estimate, using the same method, will result in lower-than-expected premiums for 2014 without the ACA—premiums lower than those estimated with the ACA in effect, and by about the same amount estimated by the CBO for nongroup plans under the ACA, roughly 7 to 10 percent.

In short, this part of the Media Matters argument is rubbish. Perhaps premiums are less than expected under the ASPE-derived estimate, but it’s not a result of the disappearance of the increased costs noted in the CBO report. Those increases remain.

“Six in 10 uninsured Americans can pay less than $100 a month with subsidies included”

The second part of Media Matters’ argument makes the first part seem brilliant by comparison:

A September 17 press release by HHS found that under the new state-based exchanges six in 10 uninsured Americans can pay less than $100 a month with subsidies included.

Subsidies do not lower premiums. Subsidies do lower consumers’ share of premiums, which is not the same thing. The latter may comfort consumers eligible for premium subsidies, but the embedded taxes in the ACA place much of the burden for paying the subsidies on those not receiving subsidies. Since subsidies do not lower insurance premiums, this point serves to distract from the fact of rising insurance premiums, not to prove the mythical nature of rising insurance premiums.

Summary

The Media Matters treatment of ACA’s effect on insurance premiums illustrates the need for a pair of important fact-checking procedures. One, use primary sources whenever possible. In this case, comparing the ASPE method to that used by the CBO helps us understand what the numbers mean. Two, avoid using fallacious reasoning in trying to support a claim of fact.

“Myth #2: Premium Prices Will Increase Due To Health Care Law”

Nongroup premiums will increase because of the ACA. It’s no myth.

Though the claim itself does not include logical fallacies, the two supporting arguments from Media Matters rely on fallacies. The first argument commits a fallacy of ambiguity by making “lower than expected” mean “no increase.” The second argument relies on a fallacy of distraction, using the availability of subsidies to some consumers as an irrelevant evidence that premiums will not increase as a result of the health care reform law.

The CBO says the ACA increases premiums in the nongroup market. FactCheck.org agrees.

Afterword

We spent some time looking into the reasons why insurance premiums have risen less steeply in the past couple of years. We’ve noted before that the slow economy probably carries most of the responsibility. The ACA’s new rules for insurers set boundaries on the minimum amount insurers may spend on services benefiting policyholders. This may result in lower premiums, chiefly by cutting the pay or jobs of insurance agents and brokers.

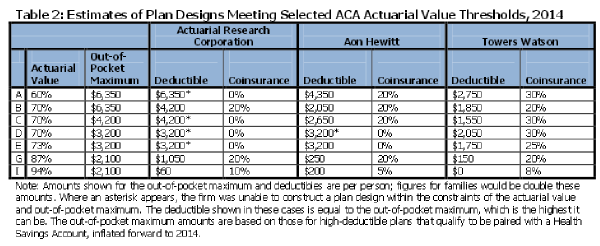

But the news lately suggests another method insurance companies will use to keep premiums low. Insurance companies offering plans on the government exchange sites can offer a lower-premium plan by hiking deductibles and co-insurance payments. Such plans continue to meet the ACA’s value standards by limiting the maximum annual out-of-pocket contribution by policyholders.

The following chart from a Kaiser Family Foundation report helps illustrate how plans can vary while having the same actuarial value.

References

Angster, Daniel, and Salvatore Colleluori. “15 Myths The Media Should Ignore During Obamacare Implementation.” Mediamatters.org. Media Matters for America, 1 Oct. 2013. Web. 21 Oct. 2013.

Angster, Daniel, and Salvatore Colleluori. “Myth #2: Premium Prices Will Increase Due To Health Care Law.” Mediamatters.org. Media Matters for America, 1 Oct. 2013. Web. 21 Oct. 2013.

Robertson, Lori. “Fact Check: Will Health Care Law Raise Insurance Premiums?” Center for Public Integrity. The Center for Public Integrity, 25 Oct. 2011. Web. 21 Oct. 2013.

Holtz-Eakin, Douglas. “Higher Costs and the Affordable Care Act: The Case of the Premium Tax.” American Action Forum. American Action Forum, 9 Mar. 2011. Web. 21 Oct. 2013.

Condon, Stephanie. “Premiums on Obamacare Marketplaces Beat Expectations, Report Shows.” CBSNews. CBS Interactive, 25 Sept. 2013. Web. 21 Oct. 2013.

“Significant Choice and Lower than Expected Premiums Available in the New Health Insurance Marketplace.” Hhs.gov. U.S. Department of Health and Human Services, 25 Sept. 2013. Web. 21 Oct. 2013.

“Health Insurance Marketplace Premiums for 2014.” ASPE. U.S. Department of Health and Human Services, Sept. 2013. Web. 21 Oct. 2013.

Skopec, Laura, and Richard Kronick. “Market Competition Works: Proposed Silver Premiums in the 2014 Individual Market Are Substantially Lower than Expected.” ASPE. U.S. Department of Health and Human Services, 9 Aug. 2013. Web. 21 Oct. 2013.

“An Analysis of Health Insurance Premiums Under the Patient Protection and Affordable Care Act.” CBO.gov. Congressional Budget Office, 30 Nov. 2009. Web. 21 Oct. 2013.

“CBO and JCT’s Estimates of the Effects of the Affordable Care Act on the Number of People Obtaining Employment-Based Health Insurance.” CBO.gov. Congressional Budget Office, Mar. 2012. Web. 21 Oct. 2013.

Carey, Mary Agnes. “FAQ: What Is The ACA’s ‘Reinsurance Tax’?” Kaiser Health News. Henry J. Kaiser Family Foundation, 15 Oct. 2013. Web. 21 Oct. 2013.

“Health Cost Increases in 2013 Were Lowest in Decade: Aon Hewitt.” Insurance Journal News. Wells Media Group, Inc., 17 Oct. 2013. Web. 21 Oct. 2013.

White, Bryan W. “Consumer Reports Repeats Administration Claim of Obamacare Savings.” Zebra Fact Check. Zebra Fact Check, 14 July 2013. Web. 21 Oct. 2013.

Armour, Stephanie. “Patients Pay Before Seeing Doctor as Deductibles Spread.” Bloomberg.com. Bloomberg, 14 Oct. 2013. Web. 21 Oct. 2013.

“Affordable Care Act Trade-off: Low Premium, High Deductible.” King5.com. King Broadcasting Company, 25 Sept. 2013. Web. 21 Oct. 2013.

Levitt, Larry, and Gary Claxton. “What the Actuarial Values in the Affordable Care Act Mean.” Kaiser Family Foundation. Kaiser Family Foundation, Apr. 2011. Web. 21 Oct. 2013.