“(Sen. Bernie) Sanders said, ‘In 1952, the corporate income tax accounted for 33 percent of all federal tax revenue. Today, despite record-breaking profits, corporate taxes bring in less than 9 percent.'”

“(Sen. Bernie) Sanders said, ‘In 1952, the corporate income tax accounted for 33 percent of all federal tax revenue. Today, despite record-breaking profits, corporate taxes bring in less than 9 percent.'”

… we rate his claim Mostly True.”

—PolitiFact, from an Aug. 28, 2014 fact check of Sen. Bernie Sanders (I-Vt.)

Overview

PolitiFact concocts a “Mostly True” rating for a claim it largely undermined. And fails to uncover other evidences undercutting Sen. Sanders’ argument.

The Facts

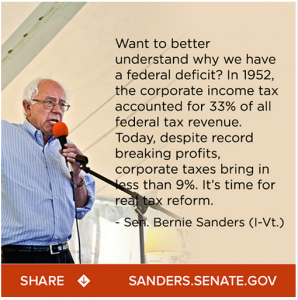

On Aug. 28, 2014 PolitiFact published a fact check of Sen. Bernie Sanders, a self-described socialist who runs for office as an Independent. Sanders produced a graphic intended to briefly make the case for reforming the tax code. PolitiFact quoted the entire text from Sanders’ graphic but focused only on his statistics while ignoring the content of his argument for tax reform. Sanders says lower revenues from corporate income taxes, as a percentage of total federal revenue, make the case for tax reform.

On Aug. 28, 2014 PolitiFact published a fact check of Sen. Bernie Sanders, a self-described socialist who runs for office as an Independent. Sanders produced a graphic intended to briefly make the case for reforming the tax code. PolitiFact quoted the entire text from Sanders’ graphic but focused only on his statistics while ignoring the content of his argument for tax reform. Sanders says lower revenues from corporate income taxes, as a percentage of total federal revenue, make the case for tax reform.

PolitiFact ruled Sanders’ claim “Mostly True,” with the caveat that the individual income tax takes a bigger share of corporate taxes than in Sanders’ baseline year of 1952.

Analyzing the Rhetoric

Upon reading PolitiFact’s fact check of Sanders we were struck by PolitiFact’s failure to address Sanders’ argument. PolitiFact often examines the underlying point of a factual claim. Why not this one?

We ran across another curiosity upon starting our research. PolitiFact did a fact check requiring very similar research back on July 3, 2012. PolitiFact ruled “Mostly False” a literally false statistical claim from “The Other 98” about corporate taxes. The claim escaped a “False” rating thanks to its underlying argument: “The one thing the Facebook claim gets right is that corporations are carrying less of the burden for taxation now compared to 1950.”

PolitiFact’s approach was surprisingly different in this fact check. Did PolitiFact miss anything significant? How has corporate taxation changed in the past six decades? And does lower revenue from corporate income taxes argue for tax reform?

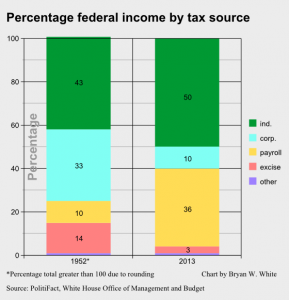

The Social Security distortion

PolitiFact’s fact check of “The Other 98” contained an implicit observation absent in its later fact check of Sanders. Changes in payroll taxes (Social Security, hospital insurance) make a big difference in the percentage of total federal revenue made up by individual and corporate taxes. PolitiFact’s chart in the Sanders fact check tells the story, showing payroll taxes increased from 10 percent to 36 percent of total federal revenue from 1952 to 2013. The other biggest change on PolitiFact’s chart comes from excise taxes, which decreased from 14 percent of the total down to 3 percent. The sharp growth in payroll taxes naturally shrinks the relative share of other revenue sources.

Changes in tax revenues from corporations

In its fact check of Sanders, PolitiFact notes that many businesses have taken advantage of the opportunity to file taxes as S-corporations, allowing those businesses to pay individual income taxes instead of corporate income taxes (bold emphasis in the original):

• Today, most business income is taxed through the individual income tax code, rather than the corporate code. This concerns a distinction only a CPA could love. One type of corporation, a “C-corporation,” pays corporate income taxes on its profits. Another type, the “S-corporation,” pays taxes on its profits through the individual income-tax returns of the owner.

Whether or not only a CPA loves the distinction between a C-corporation and an S-corporation, this finding potentially undermines Sanders’ entire argument. If corporations pay a substantial percentage of their entire tax bill via individual tax forms, measuring the decline in revenue from corporate taxes gives a poor measure of tax revenue collected from corporations.

Does lower revenue from corporate taxes imply a need for reform?

The shift of corporate income toward the individual tax collection route, as noted above, puts Sanders’ entire argument in jeopardy. The decrease in revenue from corporate taxes, together with the dramatic increase in revenue from payroll taxes, promote the misleading impression that corporations pay far less than in 1952.

We get a much more accurate picture of corporate taxation by looking at tax revenue as a percentage of gross domestic product and removing payroll taxes from the picture. PolitiFact did the former in its fact check of Sanders, and the latter in its fact check of “The Other 98.”

We get a much more accurate picture of corporate taxation by looking at tax revenue as a percentage of gross domestic product and removing payroll taxes from the picture. PolitiFact did the former in its fact check of Sanders, and the latter in its fact check of “The Other 98.”

Estimating the corporate share of federal tax revenue

We do not know the share of individual income tax revenue paid by S-corporations. We’ll calculate a very rough and perhaps conservative estimate by assuming that if half of corporate income is taxed as individual income then taxes on that income equal half the revenue from corporate taxes. Corporate tax revenue makes up 35 percent of total federal revenue minus payroll taxes in 1952. That percentage decreases to 22 percent in 2013 under our assumption.

PolitiFact’s method exaggerates the decrease in corporate taxation by not taking the corporate share into account for its calculation and by not bothering to calculate the change in the percentage share borne by corporations. PolitiFact simply compares corporate taxation in 1952 and in 2013 as a share of GDP. Total on-budget taxes as a share of GDP were higher in 1952.

The story in the numbers

The story in the numbers

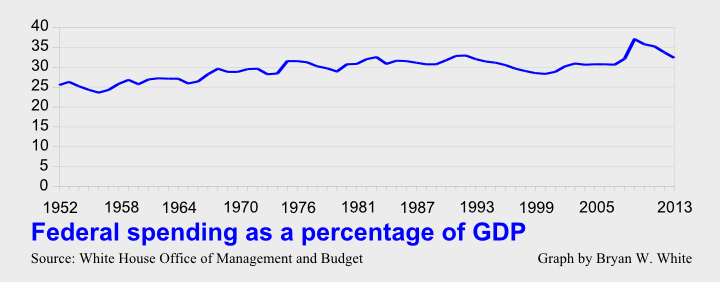

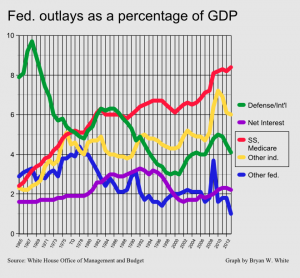

Looking at the complete tax picture from 1952 through 2013, we get better insight into the national debt than the one Sanders offers. Total receipts were 18.5 percent of GDP in 1952, and from 1952 through 2013 saw a high of 19.9 percent in 2000 and a low of 14.2 in 2009 and 2010. Average federal tax revenue as a percentage of GDP was about 17.3 percent. The increasing percentage of tax revenue accounted for by the payroll tax represents the big change over the years. And that’s just the revenue side of the story.

Off-budget spending was 3.8 percent of GDP in 2013. It was a mere 0.5 percent in 1952. Take away off-budget spending and federal outlays average 16.5 percent of GDP since 1952—less than the average for federal revenues over that span by an average 0.8 percent of GDP. In other words, keep off-budget spending at 1952 levels and the federal budget produces a consistent surplus.

This is not to say we should drastically cut off-budget or entitlement spending. It simply helps put the federal debt picture in perspective. Federal spending increases drive the federal debt, not cuts to corporate taxation. Sanders’ argument is wrong. PolitiFact either failed to notice or neglected to tell its readers.

PolitiFact’s misleading misdeeds

Sen. Sanders misleads by cherry-picking statistics that help illustrate his false claim. We find PolitiFact gives Sanders’ deception a helpful boost by focusing on the statistics instead of the faulty argument, and by treating Sanders’ use of the statistics not so much like fact checkers so much as stage managers. Where PolitiFact found a problem with Sanders’ use of statistics it also found the ability to ignore the problem in its final rating of “Mostly True.”The sole exception, the shift of corporate tax revenue to the individual tax revenue stream, by itself may put the accuracy of Sanders’ claim in the toilet.

We also fault PolitiFact for failing to note the distorting effects of a threefold increase in payroll taxes since 1952. In addition, its fact checks gloss over the way taxes on corporations, not to mention excise taxes, get passed on to individuals as embedded taxes. Even if S-corporations did not exist, there’s no neat separation between corporate taxes and individual taxes.

Though Sanders claim was different from the one made by “The Other 98,” the fact checking method should have proved very similar for both. The method varies despite the same author and editor sharing responsibility for both. For example, the fact check of “The Other 99” spent time dividing payroll taxes between employers and employees as one method of evaluation. The Sanders fact check put no emphasis at all on payroll taxes.

High corporate profits, low corporate taxes?

High corporate profits, low corporate taxes?

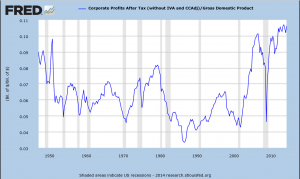

One part of Sanders’ argument stands up reasonably well. He said corporate profits stand at an all-time high, which PolitiFact confirmed with information from the St. Louis Federal Reserve (graph to right). Combined with the low tax receipts on corporate profits this does create something of a mystery. But it’s one the Wall Street Journal addressed back in 2012.

The Journal reports businesses have aggressively used a tax break called “bonus depreciation” to cut their tax bills. The Journal says the temporary tax break, passed as part of the American Recovery and Reinvestment Act and renewed in weaker form under the American Taxpayer Relief Act of 2012, allows companies to depreciate purchases when they’re made instead of over time.

If bonus depreciation doesn’t fully explain the drop in corporate tax receipts then an argument for corporate tax reform still waits in the wings.

Summary

“‘In 1952, the corporate income tax accounted for 33 percent of all federal tax revenue. Today … corporate taxes bring in less than 9 percent.'”

Sen. Sanders’ claim is true without requiring charitable interpretation, but he leaves out the growing corporate share of individual income tax receipts. His ambiguous wording leads his audience to discount that unknown share.

“Want to better understand why we have a federal deficit?”

Sanders argument, that the drop in corporate tax revenue provides an explanatory key to the federal deficit, holds no water. Growth of entitlement spending provides a powerful long-term explanation for deficit trends since Sanders’ benchmark year of 1952.

“Despite record breaking profits”

It’s true corporations report record profits in recent years, so it makes sense to seek an explanation. Much of the explanation appears to stem from temporary changes to corporate taxation made in response to the recession.

“Mostly True.”

PolitiFact’s ruling on Sanders’ statement gives the misleading impression that Sanders has a coherent argument for corporate tax reform. PolitiFact reports reasons to distrust Sanders’ statistics yet apparently ignores those reasons when rating his statement “Mostly True.”

PolitiFact’s method seems akin to hearing the claim that blowing out all the birthday candles on a cake results in a fulfilled wish, then testing the claim by looking at whether the candles were blown out. And not doing a particularly good job of that.

Yes, it’s trivially true that corporate tax receipts make up a smaller share of federal income now than in 1952. It’s also very misleading in context, and PolitiFact did not bother exploring Sanders’ misdirection. PolitiFact’s omission lays a rhetorical boobytrap for readers, encouraging acceptance of Sanders’ argument.

Correction June 14, 2015: Replaced graph showing U.S. GDP with a fixed version that corrected a typographical error.

References

Jacobson, Louis. “Bernie Sanders Says Tax Share Paid by Corporations Has Fallen from 33% to 9% since 1952.” PolitiFact. Tampa Bay Times, 28 Aug. 2014. Web. 01 Sept. 2014.

Jacobson, Louis. “Facebook Post Compares Corporate, Individual Tax Burden in 1950, Today.” PolitiFact. Tampa Bay Times, 03 July 2012. Web. 01 Sept. 2014. “Social Security & Medicare Tax Rates.” Social Security. Social Security Administration, n.d. Web. 01 Sept. 2014.

“Historical Tables.” The White House Office of Management and Budget. The White House, n.d. Web. 01 Sept. 2014.

Table 2.3—Receipts by Source as Percentages of GDP: 1934–2019

Table 15.3—Total Government Expenditures as Percentages of GDP: 1948–2013

Penner, Rudolph G. “Taxes and the Budget: What Does It Mean for a Government Program to Be “off-budget”?” Tax Policy Center. The Urban Institute, 07 Dec. 2007. Web. 01 Sept. 2014.

Cary, Mary Kate. “The Shocking Truth on Entitlements.” U.S. News & World Report. U.S. News & World Report LP., 19 Dec. 2012. Web. 01 Sept. 2014.

“Graph: Corporate Profits After Tax (without IVA and CCAdj)/Gross Domestic Product.” – FRED. Federal Reserve Bank of St. Louis, n.d. Web. 01 Sept. 2014.

Paletta, Damien. “With Tax Break, Corporate Rate Is Lowest in Decades.” The Wall Street Journal. Dow Jones & Company, 03 Feb. 2012. Web. 01 Sept. 2014.