The Congressional Progressive Caucus: “Across the board tax rate cuts are regressive because a 20 percent tax cut for a millionaire – even as a share of income – amounts to a far greater benefit than a 20 percent cut for a hardworking low income American.”

The Congressional Progressive Caucus: “Across the board tax rate cuts are regressive because a 20 percent tax cut for a millionaire – even as a share of income – amounts to a far greater benefit than a 20 percent cut for a hardworking low income American.”

Overview

On Dec. 1, 2012 the Congressional Progressive Caucus released its guiding principles for tax reform. The principles included the claim that across-the-board income tax cuts were regressive because a millionaire receives a greater benefit from the cut than a low income worker. The claim is false except for any exceptional cases where the existing system lacks progressivity in comparing a millionaire’s tax rate to that of a low income worker.

The Facts

The CPC statement, in context:

It is a bedrock principle of fairness that those with higher incomes should pay progressively higher tax rates. Any tax reform must ensure that each fifth of the income distribution (as well as the top 1 percent and top 0.1 percent) should have a higher average effective tax rate than the income group below. Across the board tax rate cuts are regressive because a 20 pecent tax cut for a millionaire – even as a share of income – amounts to a far greater benefit than a 20 percent cut for a hardworking low income American.

To maintain or strengthen progressivity, we should end one of the leading contributors to after-tax income inequality in this country, the special tax breaks for investment income. Workers who get their salaries from wages often pay a higher effective tax rate than wealthy individuals like Mitt Romney and Warren Buffett who make most of their income from selling stocks and bonds or from dividends. This undermines the basic tenant [sic] that average tax rates should rise with income. In fact, the richest 1 percent of taxpayers receives 71 percent of all capital gains, while the bottom 80 percent of taxpayers receives only 10 percent of capital gains. We should treat all capital gains and qualified dividends as ordinary income, an approach President Reagan once signed into law.

Brian Roach defines “regressive” and “proportional” tax systems in a 2003 working paper for the Global Development and Environment Institute:

A regressive tax system is one where the proportion of income paid in taxes tends to decrease as one’s income increases. A proportional, or flat, tax system simply means that everyone pays the same effective tax rate regardless of income.

The IRS defines the regressive tax similarly, calling it “A tax that takes a larger percentage of income from low-income groups than from high-income groups.”

When examining whether a tax system qualifies as progressive or regressive, the total income, not the taxable income, should serve as the denominator when calculating the effective tax rate. Exempt income is effectively taxed at a 0 percent rate.

Analyzing the Rhetoric

The full context of the CPC statement helps make clear that it refers to the income tax system broadly rather than just to the income tax brackets. That allows the statement to refer to income taxed at the flat capital gains rate of 15 percent and compare that to the rate paid by a worker in a lower income tax bracket. For 2011, the lowest three tax brackets were 10 percent, 15 percent and 25 percent.

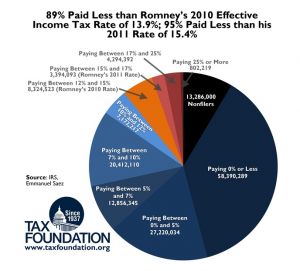

Because the tax brackets represent marginal rates, the CPC’s hypothetical low income worker needs to make more than $34,500 in taxable income to have a chance of paying a higher effective tax rate than a millionaire. In 2011, a person making exactly $34,500 in taxable income paid the 10 percent rate on the first $8,500 and the 15 percent rate on the next $26,000. That’s an effective rate of 13.8 percent on the worker’s taxable income. The Tax Foundation examined the issue of effective federal income tax rates as a percentage of overall income. It found that for the tax year 2010 over 89 percent of tax filers have a lower effective tax rate than Mitt Romney’s rate of 13.9 percent.

The Tax Foundation examined the issue of effective federal income tax rates as a percentage of overall income. It found that for the tax year 2010 over 89 percent of tax filers have a lower effective tax rate than Mitt Romney’s rate of 13.9 percent.

Corporate Income Taxes and the Effective Tax Rate

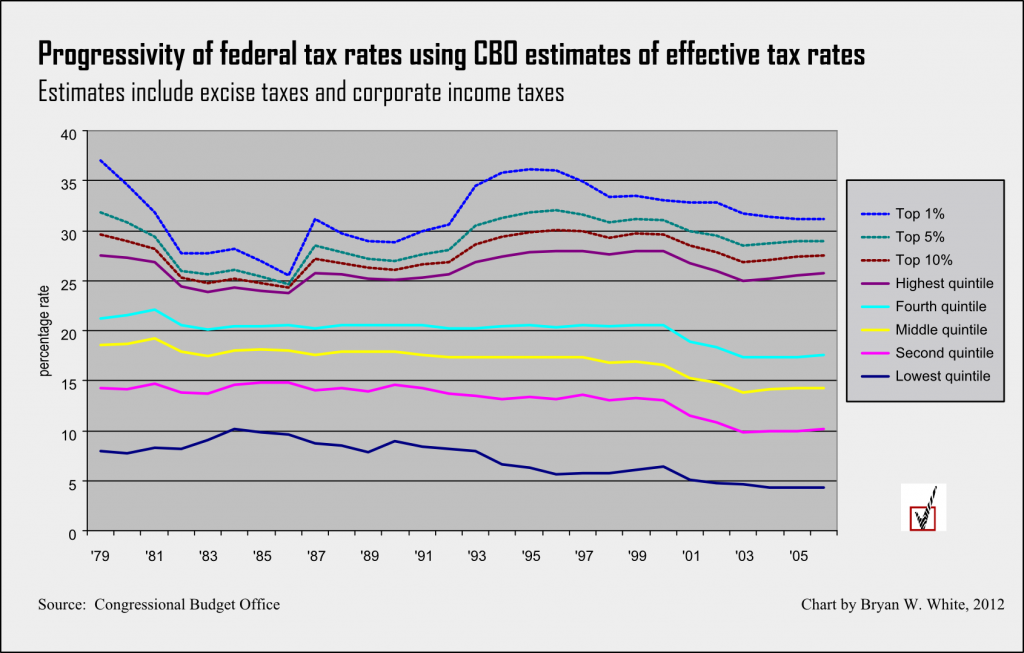

Because all corporations are ultimately owned by people, corporate income taxes are ultimately paid by people. Corporate income taxes are not ordinarily calculated as part of the effective tax rate for purposes of the individual income tax despite the frequently aired complaint that taxes on dividends and capital gains represent double taxation. But the widely respected Congressional Budget Office has calculated effective tax rates including estimates for the effects of (regressive) excise taxes and (progressive) corporate taxes. The results push the claim from the CPC further into the realm of implausibility.

The chart makes clear the strong progressive character of the current tax system along with its recent trend toward greater progressivity among the quintiles. The effective federal tax rates for the bottom four quintiles have decreased substantially (3 to 4 percentage points) since 1979 while that of the highest quintile has decreased mildly (by about 2 percentage points).

As of 2005 the federal tax system met all the listed goals of the Congressional Progressive Caucus in terms of the effective tax rates estimated by the CBO. Each quintile pays a higher rate than the one below, and the top 1 percent pay a higher rate than the top 5 percent while the latter pay a higher rate than the top 10 percent.

As of 2005 the federal tax system met all the listed goals of the Congressional Progressive Caucus in terms of the effective tax rates estimated by the CBO. Each quintile pays a higher rate than the one below, and the top 1 percent pay a higher rate than the top 5 percent while the latter pay a higher rate than the top 10 percent.

While cases may exist where a millionaire avoids paying taxes because of financial losses, it is far from the norm that a person in either of the lowest two quintiles will pay a higher effective tax rate than a millionaire. So long as the base system is progressive, across the board tax cuts will not result in regressive tax effects.

An across the board tax rate cut does result in more tax saving for a millionaire, but those savings will be proportional to the existing tax rates. A progressive set of tax rates will remain progressive after an across-the-board cut. A regressive set of tax rates will remain regressive after an across the board cut.

What about the highest incomes in the highest quintile?

Measurements of progressivity in subdivisions of the highest quintile show more variation than in the quintiles, with a trend over time toward less progressivity between the categories representing the highest incomes. That trend has little bearing on the CPC statement since the statement we’re looking at does not, for example, advocate expanding progressivity in those higher income categories.

Conclusion

Even if a millionaire retains much more money as a result of an across-the-board tax cut, it does not follow that the tax cut has regressive effects. The CPC rhetoric encourages the audience to think otherwise. Regressive tax effects are measured as a proportion of income, not in terms of raw dollars. The CPC statement does not reflect an accurate understanding of tax effects, and thus falls into the broad category of the non sequitur (“doesn’t follow”) fallacy (see addendum below).

This item received a correction not long after publication. Read about it here.

Addendum 12/10/2012

A reader cites the Center on Budget and Policy Priorities in claiming that across the board tax cuts are regressive and recommending that position as a charitable interpretation.

The argument operates by changing the denominator for tax changes from total income to after tax income, which in effect changes the definition of a regressive tax. Using this definition, a proposed sales tax may go in the course of one year from regressive to progressive with respect to a millionaire depending on a radical increase in the progressivity of the income tax. The millionaire’s after-tax income, after all, may in principle be reduced via income taxes below that of a middle-income earner. The irony, of course, is that a highly progressive income tax could allow the lowest income earners to reap the greatest proportional benefits of an across-the-board tax cut where millionaires’ after-tax incomes are negligible.

It’s potentially true that as a percentage of income after taxes an across-the-board tax cut benefits the higher income earners more in a progressive system. As a percentage of total income, the across-the-board tax cut is proportional, not regressive.

We accept changing the definition of regressive taxation as a charitable interpretation that would make the CPC statement true if accepted. Thus far we see little evidence in the professional literature to support the alternative definition. The imprimatur of the Center on Budget and Policy Priorities is enough to justify granting the benefit of the doubt.

References

“Hot Topics : CPC “Gang of Six” Releases Framework for Tax Reform.” Congressional Progressive Caucus. Congressional Progressive Caucus, 1 Dec. 2012. Web. 03 Dec. 2012.

Roach, Brian. “Progressive and Regressive Taxation in the United States: Who’s Really Paying (and Not Paying) Their Fair Share?” Global Development and Environment Institute. Tufts University, Dec. 2010. Web. 3 Dec. 2012.

“Glossary.” Understanding Taxes. Internal Revenue Service, n.d. Web. 03 Dec. 2012.

Perez, William. “Tax Rates for the 2011 Tax Year.” About.com Tax Planning: U.S. About.com, n.d. Web. 03 Dec. 2012.

McBride, William. “At Least 90 Percent of Americans Have a Lower Income Tax Rate than Romney.” Tax Foundation. Tax Foundation, 17 Aug. 2012. Web. 03 Dec. 2012.

Piketty, Thomas, and Emmanuel Saez. “How Progressive Is the U.S. Federal Tax System? A Historical and International Perspective.” Journal of Economic Perspectives 21.1 (2007): 3-24. Web. 03 Dec. 2012